VANTAGE POINT

News . Views . Reviews

Railways mulling insurance for baggage, laptops and even mobiles

Sept 16, 2016

With 40 lakh people opting for passenger insurance since its launch early this month, Railways is now planning to roll out insurance for baggage, mobiles and laptops in the insurance cover.

There are also plans to expand the existing passenger insurance to include station and ticketing areas so that passengers get the cover in case of any untoward incident on station premises.

“As of now the insurance covers passenger from boarding to alighting from train. We are planning to extend it on station and ticketing areas also. There is potential to extend it to baggage and other valuables like mobile and laptop,” said IRCTC Chairman and Managing Director A K Manocha.

According to IRCTC (Indian Railway Catering and Tourism Corporation), there is immense potential to expand the insurance cover and this would bring down the premium amount. IRCTC along with three private companies provide the insurance cover.

Manocha said the response to passenger insurance was massive and plans of extending the insurance cover had to be worked out. The organisation is also planning to extend the service to unreserved passengers. It is also modifiying the ticket-booking website so that medical insurance automatically gets added to the ticket. The passenger has to opt out if the person is not interested in getting the cover. Presently, the insurance option has to be ticked while booking the ticket.

Since September 1, passengers booking tickets online have an option to get an insurance cover of up to `10 lakh by paying a premium of 92 paise. Insurance can be claimed if any untoward incidents, including terrorist attack, dacoity, rioting, shootout or arson, occurs. The scheme is a great success and on Tuesday, Railway Minister Suresh Prabhu tweeted, “Number of people opting for new insurance scheme crossed 4 million mark. Scheme a great success and it is one among many passenger friendly initiatives.”

The scheme offers travellers/nominees/legal heirs a compensation of `10 lakh in the event of death or total disabilty, `7.5 lakh for partial disability, up to `2 lakh for hospital expenses and `10,000 for transporting mortal remains from the place of a train accident.

Three companies — ICICI Lombard General Insurance, Royal Sundaram General Insurance and Shriram General Insurance provide the insurance. They have been engaged for one year with the provision of extending the contract on the basis of performance basis.

Source: The New Indian Express

Insurance for train travellers takes off

Sept 16, 2016

The makeover of Indian Railways has been in the making for a while now. The latest move by the government is to bundle travel insurance along with your train ticket—much like what the airlines do.

The Ministry of Railways announced optional travel insurance earlier this month, and it seems to have become popular as every second booking—of about 700,000 tickets booked online each day—is opting for the insurance, said Dipankar Acharya, country head, affinity and strategic relationships, Royal Sundaram General Insurance Co. Ltd. The government is implementing the scheme in partnership with ICICI Lombard General Insurance Co. Ltd, Royal Sundaram and Shriram General Insurance Co. Ltd.

The scheme is applicable only to online bookings, and will be on trial for 1 year. When asked if it will be extended to offline bookings as well, an Indian Railway Catering and Tourism Corp. (IRCTC) spokesperson said: “Eventually it may happen. But for now, this insurance scheme has been started for a period of one year for online ticket buyers only.”

Here’s a look at the important working aspects of the insurance scheme.

WHAT IS ON OFFER?

“It is a group insurance policy given on an individual basis,” said Sanjay Datta, chief, underwriting and claims, ICICI Lombard General Insurance. A premium of 92 paise per passenger is charged while booking the ticket, if you opt for insurance. “This amount will remain the same irrespective of the duration and distance of the journey,” Datta said. The insurance is optional, but once opted, all passengers under one PNR (passenger name record) will be covered. The insurance option is currently available for online bookings or e-tickets. It excludes suburban trains. Also, children below 5 years of age are not covered.

While the option is currently available for bookings through the IRCTC ticketing portal, it will soon be made available for all the other online modes of booking tickets.

“We are currently working on the integration of the systems. Once it is complete, this facility will get extended to the railway ticket booking app users as well as to travel agents,” Acharya said.

WHAT IS AN ACCIDENT?

For the purposes of this scheme, accidents and victims are defined according to the sections 123, 124 and 124-A of the Railways Act, 1989.

An accident could be a collision between trains, of which at least one is a passenger train; or the derailment of a train; or other accident to a train or any part of a train carrying passengers. However, according to the section 124-A of the Act, compensation cannot be claimed if a passenger dies or suffers injury due to suicide or attempted suicide. Self-inflicted injuries, acts committed by passengers in a state of intoxication or insanity, natural death and injuries on account of “adventurous sports” are not covered. So, don’t expect a compensation if you lose a limb by falling from the roof of a train.

The insurance cover extends to acts of terrorism; violent attacks like robbery, dacoity and shoot-outs; and arson in a train carrying passengers. The coverage lasts for the actual time period of the journey, including arrival and departure.

WHAT DO YOU GET?

The insurance provides a cover of Rs10 lakh in case of death or permanent total disability. For permanent partial disability the cover is up to Rs7.5 lakh. For hospitalisation expenses, the cover is up to Rs2 lakh and Rs10,000 for transportation of mortal remains of a victim. Coverage of hospitalisation expenses is in addition to the coverage of disability and death.

Passengers who opt for the insurance will be able to make the claim in addition to the compensation that the government gives in case of an accident or untoward incident. “This insurance is over and above the ex-gratia compensation that is given to accident victims,” the IRCTC spokesperson said. According to the Railway Accidents and Untoward Incidents (Compensation) Amendment Rules, 1997, the government gives a compensation of Rs4 lakh in case of death and up to Rs4 lakh in case of injuries and permanent disabilities.

HOW TO FILE A CLAIM?

If you opt for insurance, you will need to update the nominee details on the insurance company’s website. The link to this website will be provided, along with policy number, though an SMS. If a passenger does not update these details, the claim will be settled with the legal heirs of the policyholder.

The claims will have to be filed within 4 months of the date of accident, along with a report from the railway authorities on the accident and the list of dead passengers, in case of a death claim.

Source: LiveMint.com

Cabinet readies for listing of PSU insurance firms

Sept 9, 2016

The government's plan to list public sector general insurers is gaining momentum with additional details such as business numbers and financial projections being sought from these insurers. A note is currently being prepared for the listing proposal to be presented before the Cabinet.

In his Budget speech, Finance Minister Arun Jaitley said the general insurance companies owned by the government would be listed on stock exchanges. He had said public share-holding in government-owned firms was a means of ensuring higher levels of transparency and accountability.

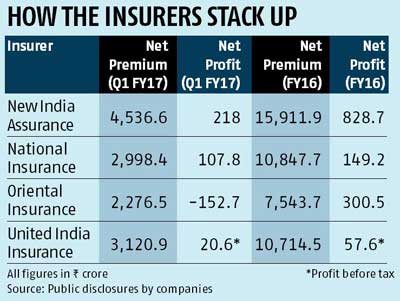

Apart from the sole domestic reinsurer General Insurance Corporation of India (GIC Re), the four public-sector insurers are New India Assurance, United India Insurance, Oriental India Insurance, and National Insurance.

"Details on our financial performances, business growth as well as future expectations from business have been sought by the ministry officials. They have also asked for information on any future areas of growth," said a senior public-sector general insurance official. Sources said the listing process and timeline would be finalised over the next few weeks. It is expected that the process will reach its advanced stages by the end of this financial year. New India Assurance could become one of the first candidates for listing, based on financial performance.

Cabinet readies for listing of PSU insurance firms There have been discussions in the past between the finance ministry and these insurers on their possible listing. It is anticipated that New India, which is among the largest in the public sector, could be the first to be taken to the listing path.

For the first quarter ended June 30, 2016, New India collected global premium of Rs 5,263 crore, with a growth rate of 14.7 per cent. Its profit after tax stood at Rs 218 crore and net worth including fair value at Rs 31,232 crore. Once the Cabinet nod is given, these insurers will internally begin to finalise all the processes and also appoint external consultants to ensure a smooth transition.

However, underwriting losses remain an area of concern for these insurers especially in segments such as health and motor third-party insurance. Once they get closer to listing, the focus would be to reduce these losses significantly, said public-sector insurance executives.

Listing will not only involve overhaul of existing processes. Experts say in the run-up to the initial public offering (IPO), the way these insurers function would have to undergo a change. While corporate governance practices are already in place, there will be more pressure on top management to refine it, say experts.

According to data from the Insurance Regulatory and Development Authority of India (Irdai), underwriting losses increased 23 per cent year-on-year from FY14 to FY15. Insurers said that on an average, there is a 20-30 per cent rise every year in underwriting losses. Public-sector insurers have seen a bigger impact of this due to the large volumes of business they underwrite every year. Among the segments, fire and property are seeing a rise in losses, especially with large claims as well as undercutting to retain clients. Similarly, the group health segment has also seen losses pile up because of heavy discounts to existing corporate customers.

Source: Business Standard

IRDAI chief calls for debate on insurance portability

Sept 9, 2016

The Insurance Development and Regulatory Authority of India (IRDAI) today said insurance portability will be the next big issue the industry should take up.

IRDAI chief T.S. Vijayan said there is no initiative from the regulator on the issue of portability, but he wants the idea to be debated in various forums.

"Currently, portability is available only for health insurance policies. The portability (of insurance policy) is possible only if the policy is standardised. If different clauses are there, the first attempt is to make it (policy) simple and standardise the policy," Vijayan told reporters on the sidelines of a programme.

"There is no road map (for insurance portability). Digitisation of policy is the first step. Once that is done, we can think of it."

He favoured the idea of people discussing it, "then only it can emerge". "I don't say tomorrow we are going to bring that. No. We will have to ignite the thought process," Vijayan told reporters on the sidelines of a programme.

He felt that the portability would help people rate or rank the company services and choose the better one.

Vijayan said sale and servicing of insurance policies through e-commerce platform will be available from October 1.

"We want to make this mandatory for high commercial policies. If a customer wants, the company has to provide it. We want to start this from October 1 onwards," he disclosed.

His assessment is the insurance sector in the country is growing well as health insurance is pacing up at a clip of 31 per cent. The life and non-life insurance segments are expanding at about 15 per cent.

Source: The Economic Times

6 important changes brought about by new health insurance rules

Sept 7, 2016

Regulations play an important role in defining the growth and future of any industry. Recently, the Insurance Regulatory and Development Authority of India (IRDAI) introduced (Health Insurance) Regulations, 2016, replacing the rules set in 2013. The six important changes brought about by the regulations are:

* Combi plans can be a mix of any life (earlier only term plan) and health plan

* Cumulative bonus in benefit plans allowed

* Wellness benefits

* Insurers have been asked to launch pilot products

* Standard declarations format can be flexible and insurers may design them independently

* Life insurers will not be allowed to offer indemnity-based products

Let's take a look at the implications of each of them:

Combi plans can be a mix of any life (earlier only term plan) and health plan

In December 2009, IRDAI had come out with the guidelines for combi plans that would allow a life and a non-life (or a standalone health) insurer to enter into an agreement to offer such plans. Recently, IndiaFirst Life Insurance announced a collaboration with Star Health Insurance to introduce Star First Combi Plans - a combination of health and life insurance plans. It was a mix of a pure term and a health plan. From now on, a combi plan can be a hybrid of any life (endowment, money-back or Ulip) and health plan. "While the customer enjoys clubbed product benefits and unmatchable ease by managing two different plans through a single policy, the agent gets the satisfaction of offering a full package to its customers", says Vishakha R M, Managing Director & CEO, IndiaFirst Life Insurance.

Cumulative bonus in benefit plans allowed

Currently, cumulative bonus is not a feature in defined benefit policies such as critical illness plans. Going forward, it will be offered and explicitly stated in the prospectus and policy document. The addition of cumulative bonus increases the sum insured over a period of time and helps in meeting a higher treatment expense in future. But, will there be a corresponding increase in the premium of critical illness plans? Ashish Mehrotra, MD & CEO, Max Bupa Health Insurance, informs, "It will help customers grow their sum insured over the years and the corresponding increase in the premium will be insignificant."

If, however, a claim is made in any particular year, the cumulative bonus will be accordingly reduced. For every claim-free year, the sum insured is increased by a certain percentage, say 10 per cent, up to a maximum of about 50 per cent of the initial sum insured. This additional increase is the cumulative bonus that accrues to the policy.

Wellness benefits

Health insurance premium is largely a function of age and sum insured, followed by health maintenance and healthy habits. The guidelines to reward policyholders with an early entry and continued renewals were already present in the IRDAI guidelines of 2013. To incentivise healthy lives, the recent guidelines stress on rewarding policyholders on the basis of preventive and wellness habits by disclosing upfront such mechanism or incentives in the prospectus and the policy document. "This type of benefit might help customers in monitoring and improving their health. On the other hand, the insurer recognises the same and offers discount on the renewal premium," says Mehrotra.

No discount, however, will be provided on any third-party service or merchandise. For instance, insurers can't offer discounts on a health club's membership just because they have a tie-up with the club. Instead, discounts in premium or on diagnostic or pharmaceuticals or consultation services of providers in the network will still be allowed.

Insurers have been asked to launch pilot products

This new initiative may usher in a new wave in the insurance industry. IRDAI has allowed insurers to test the water by launching 'pilot products'. Close-ended with a one-year policy term, the products will be offered only by general or health insurers for just five years initially. The product can be withdrawn or rolled over into a regular one. The idea is to cover risks which have not been covered by insurers till now. Such experiments, however, should not be detrimental to the interests of policyholders. Mehrotra says, "While the insurers have the flexibility to withdraw or continue the product after 5 years, the regulator has protected the interest of the customers by putting an obligation on the insurance companies to port the customers of pilot policies to an existing product of a health insurer. This will provides customers continuity benefit and at the same time encourage insurers to innovate more and test new products."

Proposal form can be flexible and insurers may design them independently

All insurance companies, including life, general and health, can now have their own proposal form with separate set of standard declarations as part of it. The regulations, however, strictly prohibit any explicit or implicit consent of prospective buyers to part information with third-parties.

Life insurers are not allowed to offer indemnity-based products

From now on, life insurers will not be allowed to offer indemnity products. For existing policyholders, however, the policy shall continue until the expiry of the respective policy term. But won't their claim experience be hit if new policies can't be sold? "Actuarial assumptions take into account several factors, including continuity of a product and the volume of business. As a prudent insurance company, we create adequate reserves to meet expected claims liability to ensure there will be no adverse impact on the servicing and claims processing of existing policyholders", informs Vishakha.

Indemnity plans are health insurance policies such as mediclaim which reimburse the actual hospital expense incurred, i.e., indemnify the policyholder. Few years back, life insurers had started offering such plans, but now IRDAI has put brakes to it. Non-life and standalone health insurers will, however, continue to offer them. Importantly, life insurers may still offer defined-benefit health plans such as critical illness plans in which a lump sum amount, irrespective of the actual hospital expense, is paid to the policyholder. Life insurers have also been asked to not offer single premium health insurance product under unit linked platform.

Conclusion

One should ideally have adequate health insurance cover for not just oneself, but the entire family as well. Young families may opt for family floater health covers where children up to the age of 25 are covered. At around age 40, one may consider buying a critical illness cover. Keep reviewing the amount of coverage every 3-5 years and, more importantly, maintain a healthy lifestyle.

Source: The Economic Times

[1] « 44 | 45 | 46 | 47 | 48 » [62]