VANTAGE POINT

News . Views . Reviews

After the floods, a boom in the insurance sector

Oct 3, 2016

In the aftermath of the December floods, insurance firms have witnessed a 40-50 per cent increase in policy sales in Chennai and the surrounding areas. “Call it ‘fear psychosis’ or ‘being extra cautious’, Chennaiites have become more alert when it comes to protecting assets. If you rewind back to a few months ago, the insurance claims touched Rs 5,000 crore after the floods,” an insurance analyst pointed out.

The total losses due to the floods were estimated to be at least $2 billion. Insured losses were $0.8 billion, making the floods the second costliest insurance event in India on sigma records. “A large part of the losses originated from commercial lines as Chennai is home to many manufacturing companies, particularly in the motor industry,” according to an analysis by Swiss Re on natural catastrophes and manmade disasters in 2015.

While individuals are opting for household insurance and motor insurance, industries are covering their properties under fire policy, machinery insurance and motor insurance. According to Bajaj Allianz General Insurance, their home insurance portfolio has grown by 30 per cent since the floods. The premium generated has also substantially gone up by 124 per cent post the floods in December. Sasikumar Adidamu, Chief Technical Officer, Non motor, Bajaj Allianz General Insurance, said, “From January to December 2015, the company saw a month-on-month rise of 25 per cent in its home insurance premium and a 12 per cent increase in the number of home insurance policies sold in Chennai and surrounding areas.”

A senior official from The New India Assurance Company Limited said that most of the individual houses were insured only for the depreciated value or cost incurred by them at the time of construction many years ago. “Hence, they could not get full claim for their loss as the property was not insured for the current re-instatement value. House owners are now opting for renewing the policy on present replacement value to make sure they get full protection,” the official added.

Industries are also taking add-on covers such as removal of debris, architect fees, temporary removal of stocks, loss of rent and additional rent for alternative accommodation during the event of any loss. The MSME sector, where more than 14,000 units suffered loses to the tune of Rs. 11.8 lakh, is also opening doors to insurance firms.

“Before the floods, most of the industries financed by banks insured their property only to the extent of their loan amount. They are moving towards re-visiting the value for which their property was insured and revising insurance for the current value,” said an official from New India Assurance. “Entire assets including the compound wall are insured and more emphasis is given to adequacy of insurance. They are now cautious enough to get comprehensive cover for the full value of their property.”

Insurance agents agree that business has boomed after the floods. Madhavan, an insurance agent in T.Nagar, said, “In the last six months, I have enrolled people for various policies and my business has increased by 200 per cent post floods. Customers are looking at comprehensive coverage that would include their appliances. People are also willing to shell out more from their pocket for the premium,” he added.

Source: The Hindu

Smart things to know about E-insurance account

Oct 3, 2016

IRDAI has mandated having an electronic insurance (e-insurance) account to purchase insurance policies, starting 1 October 2016.

An e-insurance account is an online facility to save all insurance policy documents in a de-materialised form through a repository system.

Each account has a unique number and account holders are granted login IDs and passwords to access all electronic policies online through a common interface.

Existing insurance policies can be converted into electronic format, and new policies can be bought in an electronic format once the e-insurance account is enabled.

With e-insurance, all policy documents are secured. It simplifies the KYC process, the altering of details, getting statements and the payment of premiums.

Source: The Economic Times

A ‘healthy’ turn to innovation in insurance

Sept 27, 2016

Insurance companies deal with risk. And, as new forms of risk constantly emerge — from driver-less cars to activity-monitoring gadgets that judge health to millennials interacting only on the digital platform — insurance players have had to evolve. Interestingly, so too, the regulator.

In July 2016, the Insurance Regulatory Development Authority introduced several regulatory changes to health insurance. Such regulation has the potential to change the way risk, indemnity and other insurance products have been traditionally covered.

We take a look here at the top five changes. Note at least one thread that connects them all – an impetus to innovation.

New products

Previously, insurers required prior IRDA approval to withdraw products in the market and were therefore reluctant to introduce new products. The structure of health insurance policies was thus kept as predictable as possible and innovation in in the range of products that could be offered was stymied. The new regulations allow insurers to roll out products on a pilot basis and allow them the flexibility to even withdraw them after 5 years, without procedural hassles. While insurers still need a valid reason to withdraw the product, it allows them far more flexibility than afforded earlier and to attempt to cover risks that had not been addressed until now.

The regulatory changes, however, mandate that when pilot products are withdrawn from the market, insurers should ensure that such customers can port to an existing health insurance product of a different provider.

The regulator has also brought in transparency in mandating minimum pay-outs and product information, enabling a menu of offerings across health insurance products, portability and easy withdrawal of pilot products through the new regulations.

Wellness credit

To promote wellness and preventive health care, insurers can now offer a discount on the renewal premium in case of demonstrated improvement in health. However, parameters that qualify for improvement have to be disclosed upfront in the product prospectus. Insurers can now promote and cross-sell outpatient consultations or treatment, pharmaceuticals or health check-ups offered by the insurer’s network providers (hospitals and clinical establishments) and offer discounts in cashless transactions.

While some insurers have been providing wellness offerings and discounts, the regulator now requires them to be mentioned in the product filing. Having mentioned it in the filing, the company cannot withdraw offers without a valid reason.

Although the 2013 regulations brought in access to the insured availing of non-allopathic treatment or AYUSH (Ayurveda,. Unani, Sidha and Homeopathy), the move towards wellness and well-being has set the regulator on par with insurance regulators in the U.S. and the U.K.

Health vs finance

Life insurers can no longer offer pure indemnity-based products which assure a sum at the end of tenure. This used to resemble a financial protection plan rather than health risk cover. The aim of the new regulations seems to be to de-link financial protection-type plans from health insurance products and restore the primary objective of providing pure health cover under health insurance. It allows the health-life product players to compete on annual pricing, product packaging and rewarding good behaviour of the insured such as early subscription to a plan and continued attachment to the provider.

‘Group’ definition

Prior regulations stipulated that there should be a commonality of purpose as well as an economic or non-economic relationship among group members. Separate guidelines governed the group, group agent and the group insurer. The new regulations mandate that the minimum size of the group be fixed at 7 as compared with the arbitrary decision left to the discretion of the insurer, earlier. This is a significant step towards sanitising the competitive group insurance market. Earlier, any collection of individuals could form a group but if they did not all have a similar risk profile then, logically, the same risk cover may not hold for each of them..

Renewal norms

The renewal norms have also been made less stringent. An insurer shall not resort to fresh underwriting of his risk by calling for a medical examination or a fresh proposal form at the renewal stage of policies. (Earlier, such a possibility existed. If the insured had made a claim the previous year, renewal procedures could change.) Insurers are now encouraged to reduce loading the premium with a risk element, in case of improvement in the risk profile of the insured.

In sum, the new health insurance regulations, cognisant of dynamic market realities, enable players to innovate and compete in the health insurance ecosystem. It admirably balances customer protection and the commercial interests of the insurers.

Source: The Hindu

General insurance firms post 19% gross direct premium growth in August

Sept 23, 2016

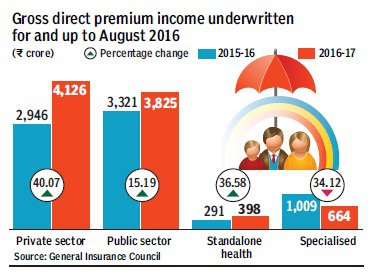

General Insurance companies continued to post positive growth at 19.1% (year-on-year)in gross direct premium in the month of August. Data from the General Insurance Council show that private players have seen high premium underwritten as compared to public sector insurance companies. While specialised insurers like ECGC and AIC continued to see negative growth in August.

The general insurance segment saw gross premium income at Rs 9,013.97 crore against Rs 7,566.81 crore in August last year. While private insurers registered gross premium income at Rs 4,126.26 crore up by 40.1% compared to last year. While public sector insurance companies saw growth of 15.2% at Rs 3,825.19 crore in August, 2016.

The general insurance segment in the last few months has seen sustained growth and higher participation from private players as against public sector insurers. “We are witnessing higher demand from fire and marine insurance compared to other public sector insurance companies.

Private insurers are already leading with high market share in motor insurance. In the last few months, private sector has seen higher growth also because of their participation in the crop insurance,” said a top insurance player. In the motor insurance segment, gross direct premium income underwritten by the non-life insurers up to August was Rs 19,314.53 crore with Rs 10,302.54 crore for private sector and Rs 9,011.99 crore for public sector firms. Apart from general insurance, stand-alone health insurance companies also saw surge in their premium income by 36.6% in the month of August. However two specialised players like ECGC and AIC saw growth of -34.1% in August.

Source: The Financial Express

Up to 6 new players may enter reinsurance market in India by January 2017: IRDA chief

Sept 20, 2016

Up to six new players in the reinsurance market are likely to enter India by January 2017, the Insurance Regulatory and Development Authority of India (IRDA) chief Mr T.S. Vijayan, said at an ASSOCHAM event.

About five-six (companies) have come and I think by January 2017, there should be some players in this market, we will be taking a decision in October in the next authority meeting, then they have to bring capital and start working at it, said Mr Vijayan while inaugurating an ASSOCHAM Global Insurance Summit.

He also said that IRDA would finalise the regulations pertaining to payment of commission or remuneration to insurance agents and intermediaries in October. I believe in next board/authority meeting, which will be in October, we will be able to finalise.

Talking about the whole process, he said, We discuss with everyone, we bring the draft, people give their feedback on it and we again discuss that thing. Then it is taken to Insurance Advisory Committee, looking at suggestions, they suggest it and then it goes to the authority.

On the listing of insurance companies, Mr Vijayan said, In the previous Act itself there was a provision for listing, this was changed, we wanted to have a discussion on this subject, so we brought out a paper and companies have expressed that thing, so let us see how it goes forward.

He said also that IRDA has not fixed any time-frame for the final regulations. I believe that discussions are going on how to list general insurance companies, all 5-6 of them.

He added that considering about five months are still left in this financial year, listing of more PSU insurance companies was possible. It is possible but I am not too sure, we have not got any official paper, it is in the discussion stage but nobody has approached us.

On the issue of insurance marketing firms, he said We have allowed to them sell up to three companies' product, these are evolving processes.

He said that though insurance industry in India has grown in terms of premium collections from Rs 45,000 crore in 2000 to Rs 4,63,000 crore in 2015-16, insurance penetration against world average and other Asian countries highlight much more ground to be covered.

We need to focus on number of lives or risks covered, spread across geographies, gender and level of insurance coverage, as clearly indicated by around 0.7 per cent only insurance penetration observed for Indian general insurance industry against world average of 2.77 per cent, said Mr Vijayan.

He said there are healthy growth prospects for insurance business in general and particularly in property, health and pension lines of business.

The IRDA chief said that home insurance penetration being very low in India, it is one of the most needed insurance cover.

Imparting financial literacy, incentivising Indian households to transfer savings from physical assets to financial assets and effective distribution among rural areas are expected to bring more and more individuals within insurance ambit, he said.

Mr Vijayan also said that multiple models and approaches are vital to ensure last mile connectivity and reach of insurance services to address diverse social, cultural, geographical features of rural India.

He said that innovation in products, their distribution should be made in a manner that people are encouraged to buy insurance cover by realising benefits, requirement and necessity. An environment must be created to facilitate the same by expanding distribution reach and improving accessibility options to consumers by optimal usage of technology.

In his address at the ASSOCHAM conference, Mr S.K. Roy, chairman, Life Insurance Corporation (LIC) said, For the life insurance industry these are the best times, as the current financial year has seen fantastic growth, August 2016 has seen stupendous growth as LIC's new business premium grew by more than 92 per cent for August.

We have yearned for long for this type of growth but seen very rarely, so definitely this is the very good time to be in the life insurance industry, said Mr Roy.

Going forward, industry will be working on a more stable platform of regulations than it was in last 12-18 months, that is also a very positive feature, added the LIC chief.

Mr C.V. Rao, Governor of Maharashtra while addressing the ASSOCHAM conference, said that with new insurance policies and various other steps being initiated by the government coupled with India's demographic dividend, it will further push the country's economy on growth trajectory.

As a country with more elderly population and growing middle class, there are plenty of business and opportunities for growth of insurance sector in India, said the Governor of Maharashtra.

Mr Sunil Kanoria, president of ASSOCHAM, in his address at the global insurance summit said, The going for most of the general insurance players has been tough as they operate in a highly competitive environment. Going forward, the route to profitability should be chartered by addressing issues of distribution channels, products, customer acquisition through greater product awareness, pricing, risk management and leveraging of technology.

Source: Business Standard

[1] « 43 | 44 | 45 | 46 | 47 » [62]